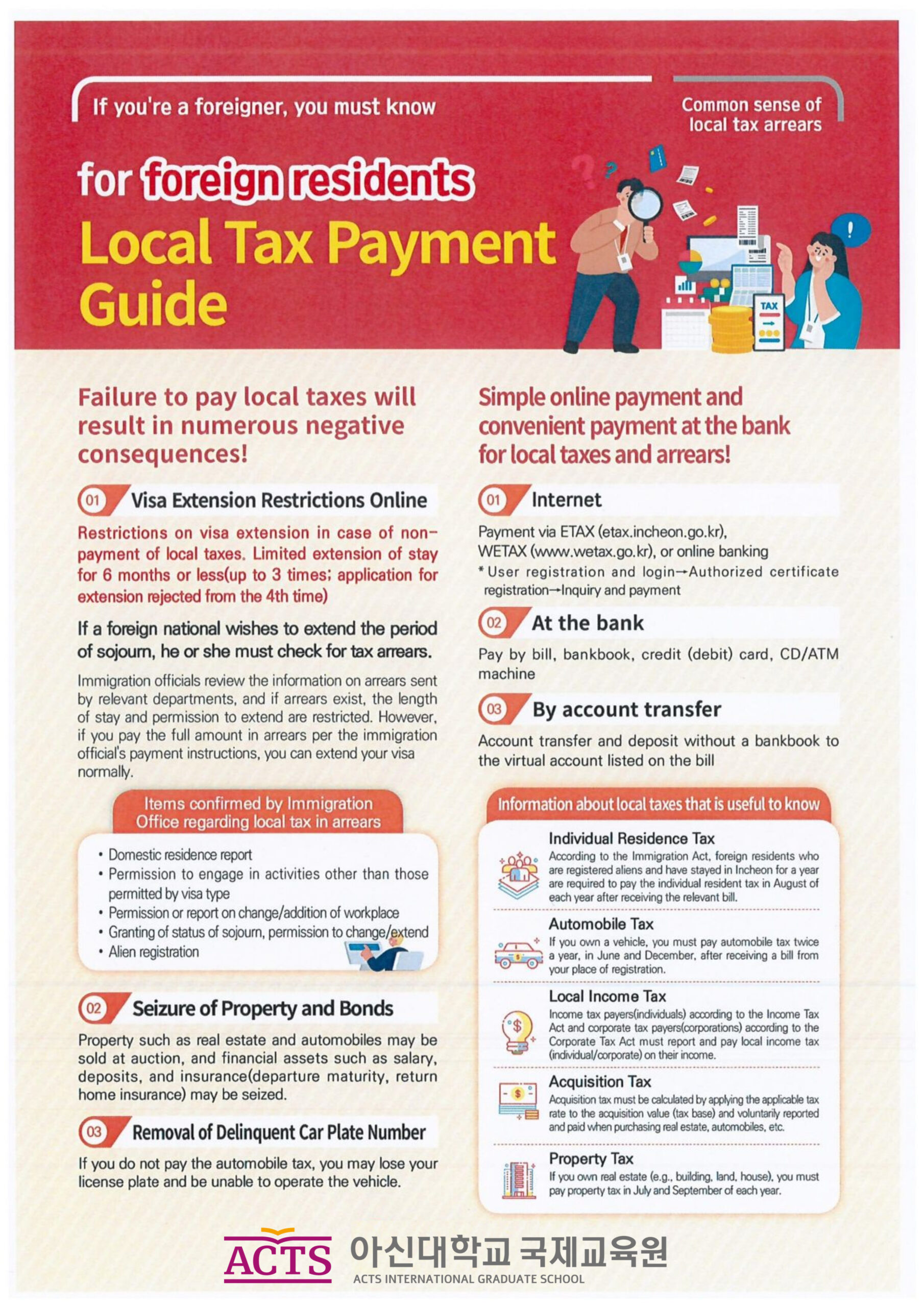

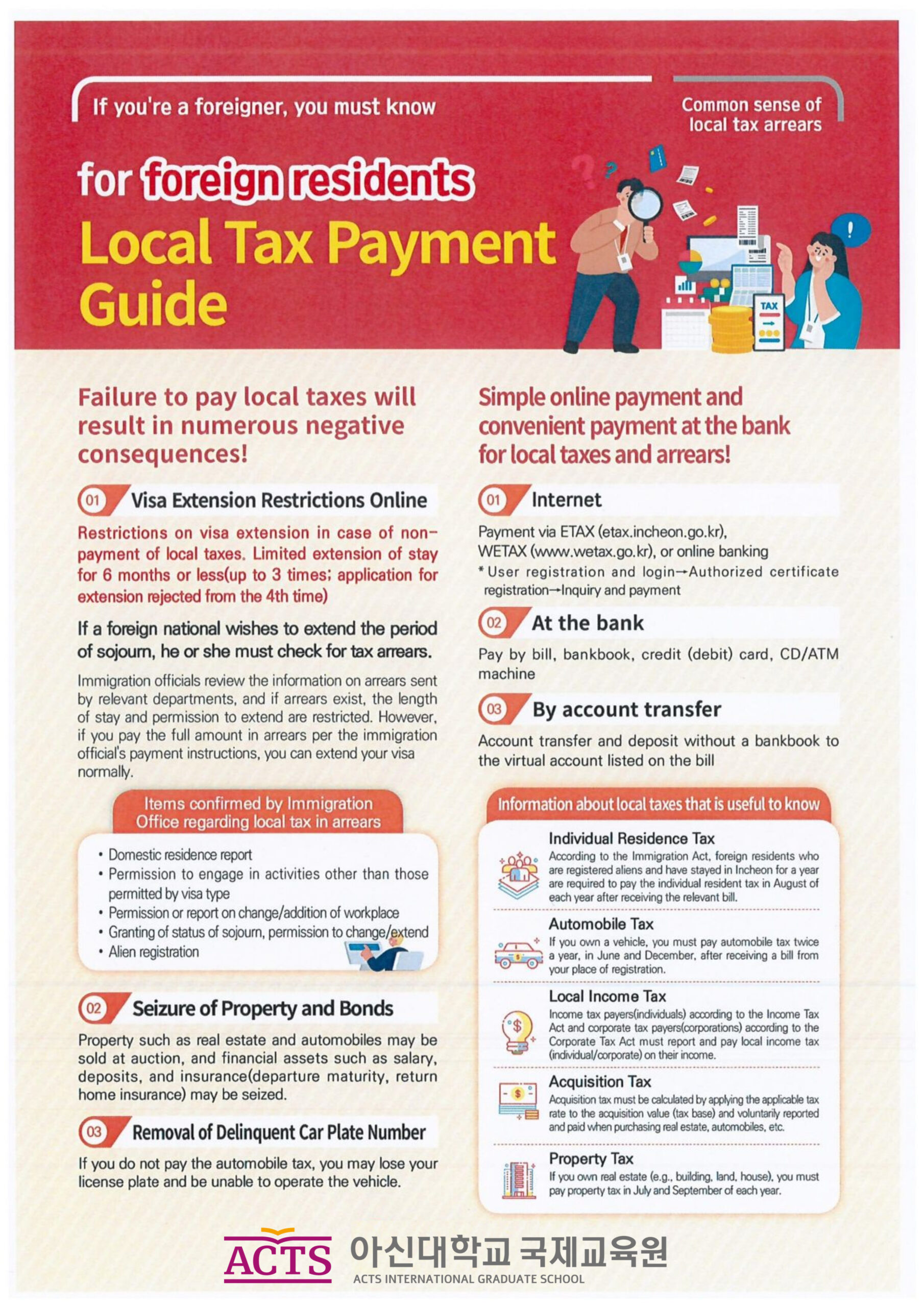

Local taxes are taxes paid by foreigners who stay for more than a year. We inform you that foreign students will also be charged from this year. In addition, we inform you that visa extension will not proceed in case of arrears.

Article 74 (Definition) The meanings of terms used in resident tax are as follows.

1. The term "individual share" means resident tax imposed on individuals with addresses in local governments.

Article 75 (Taxpayer) ① Individual taxpayers refer to the place of stay under the Immigration Control Act in the case of foreigners in the local government as of the tax base date. It shall be an individual who has an address in this chapter below. However, those who fall under any of the following subparagraphs are excluded. <Amendment 2020. 12. 29.>

1. Recipient under the national basic livelihood guarantees

2. Minors under the Civil Act (excluding cases where such minors constitute the same household under the Resident Registration Act as adults)

3. A person prescribed by Presidential Decree as a member of a household under the Resident Registration Act and an individual equivalent thereto

4. A foreigner whose one year has not elapsed from the date of registration as a foreigner under Article 31 of the Immigration Control Act